The EBA publishes its heatmap following scrutiny of the interest rate risk in the banking book

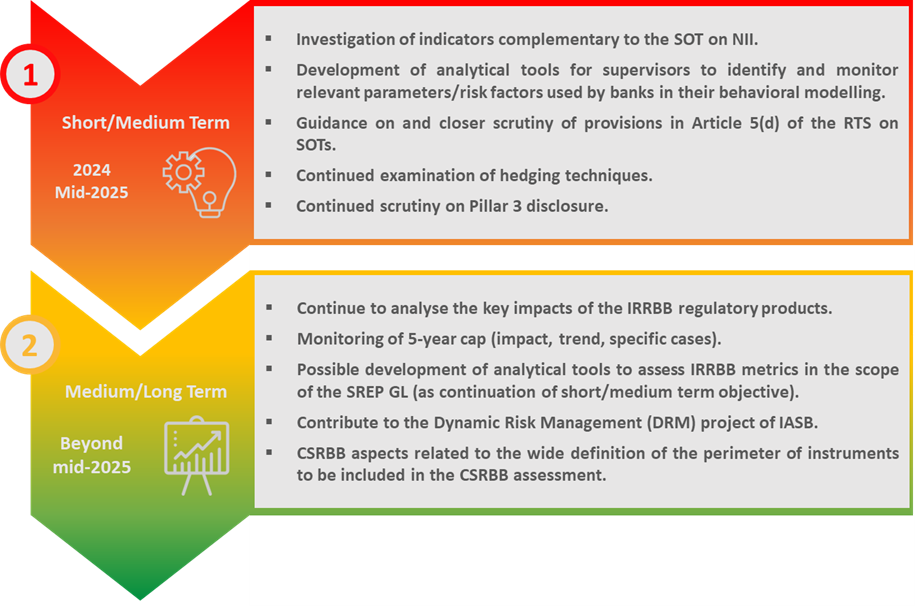

The European Banking Authority (EBA) published today its heatmap following scrutiny of the interest rate risk in the banking book (IRRBB) standards implementation in the EU. The heatmap discloses policy aspects that will be subject to further scrutiny, and corresponding actions in the short to medium and long term.

With the publication of the regulatory package on IRRBB in October 2022, the EBA communicated its scrutiny plans for IRRBB to monitor the impact on institutions from increases in interest rates and developments regarding institutions’ ability to manage the risks. These scrutiny plans cover a wide range of different dimensions. Firstly, they include scrutiny of specific aspects of the EBA Guidelines on IRRBB, such as the 5-year repricing maturity cap of non-maturity deposits (NMDs). Secondly, they include a more general assessment of the management of interest rate risk from a prudential perspective, in particular, changes in the modelling assumptions and hedging strategies used by institutions. Finally, they encompass other aspects related to the impact of increases in interest rates on capital instrument valuations or other accounting or liquidity aspects, which interact strongly with IRRBB ones.

The heatmap incorporates three sections, which describe: i) the regulatory framework for IRRBB in the EU; ii) the EBA scrutiny plans and the work undertaken to date; and iii) the main areas of scrutiny identified with the corresponding actions/timelines.

The EBA will continue its discussions with stakeholders on the various aspects identified in the heatmap while progressing on the work.

Heatmap following the EBA scrutiny on the IRRBB

Documents

Heatmap following the EBA scrutiny on the IRRBB Standards implementation in the EU

(563.04 KB - PDF)

Press contacts

Franca Rosa Congiu